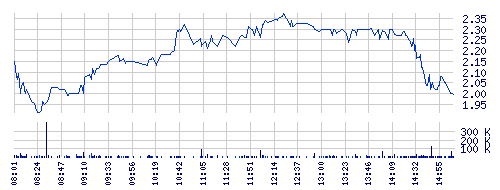

Shares in AIB and Bank of Ireland have fallen by 19% and 14% respectively already this morning ahead of fears that the Irish Government will be forced to recapitalise both banks following the announcement of new capital rules and the announcement of the discount at which the state owned bad bank (NAMA) will buy distressed development loans from the banks.

Reports across several media outlets have speculated that the extent of discounts and of recapitalisation could far exceed initial estimates, but Misnister for Finance, Brian Lenihan, has refused to confirm any speculation ahead of official announcements in the first half of this week.

The extent of the recapitalisation is likely to significantly dilute existing shareholders’ stakes in the banks and a sell-off this morning has resulted.